Main navigation

Applying for SSNs

Social Security Numbers (SSNs)

A Social Security Number (SSN) is needed to facilitate payment for scholarships, employment in the U.S., and to file a U.S. tax return. Refer to the information below to determine if you are eligible for a SSN and for instructions on how to obtain one.

Note: While any individual employed in the U.S. must apply for and obtain an SSN, they can begin working before they receive the SSN.

- Eligibility

Requirements/eligibility according to immigration status:

H-1B: You are eligible to receive a social security number.

F-1 Enrolled Student: You must have on-campus employment OR curricular practical training and be registered for classes to be eligible to receive a social security number.

F-1 Students on OPT: You must have a USCIS Employment Authorization Document to receive a social security number.

F-2 Dependent: You are NOT eligible to receive a social security number.

J-1 Student: You must have on-campus employment OR work authorization to be eligible to receive a social security number.

J-1 Student Intern: You must be paid or receiving a stipend by your hosting department at UT to be eligible to receive a social security number during your internship program. Unpaid J-1 student interns are not eligible to apply for a social security number.

J-1 Research Scholar/Professor/Short-Term Scholar: You are eligible to receive a social security number. J-2 Dependents: You must have a USCIS Employment Authorization Document (J-2 Employment Authorization).

- Social Security Tax

F-1 and J-1 students and scholars who perform authorized employment on-campus or off-campus (with permission from USCIS) are generally exempt from the payment of Social Security Tax. J-2 Dependents who work are not exempt. More information is found in Internal Revenue Service Publication 519.

- How to Apply

Step 1: Schedule Your Appointment Online

- Go to the Social Security Number & Card page. Choose the service you want. If this is your first time applying for an SSN, indicate that you are applying for the first time.

- Fill out and submit the online form to schedule your appointment. You must time your appointment properly. If your appointment is too early, there could be a significant (months-long) delay in the issuance of your SSN.

- All applicants: within 45 of scheduling your online application.

- All applicants: at least 10 days after your last entry into the U.S.

- J-1 research scholars, professors, short-term scholars, and student interns: at least three days after attending J-1 Scholar Orientation.

- F-1 and J-1 students working on-campus: at least three business days after receiving your signed Social Security Employment Verification Letter. (You can schedule the appointment before receiving the letter, but do not attend without it.)

- You should receive a confirmation email.

- While you wait for your appointment, gather your required documents in Step 2.

Step 2: Prepare Your Application Documents

Prepare the list of documents you will need to establish your immigration status and employment eligibility. The documents you need will depend on your status.

Required Documents for All Applicants

- Valid, unexpired passport

- Visa stamp

- Print-out of your Form I-94;

- Original birth certificate (recommended)

Additional Required Documents Based on Status (All Documents Must Be Physical)

Status Additional Documents F-1 and J-1 Students Employed On Campus - F-1 students: print-out of your most recently issued I-20* that you have signed at the bottom of page 1.

- J-1 students: most recently issued original DS-2019 with wet ink signature from ISSS staff in section 7.

- F-1 and J-1 students: Employment Verification Letter endorsed by ISSS.

- (J-1 students only): Complete and submit the J-1 On-campus Employment Report in myIO.

- Download the Social Security Employment Verification Letter.

- Have your employing department complete the top portion of the letter. Electronic signatures are accepted in this portion.

- Obtain a signature on the bottom portion of the letter from ISSS. To obtain ISSS's signature, please upload your completed letter in myIO and allow 5 business days for processing or bring your letter to ISSS during our walk-in hours for a same-day signature.

F-1 Students on CPT - Print-out of your CPT I-20* that you have signed at the bottom of page 1

- Job offer letter

F-1 Students on OPT - Print-out of your OPT I-20* that you have signed at the bottom of page 1.

- Job offer letter.

- Employment Authorization document (EAD) issued by USCIS (Note: you cannot apply for an SSN until the start date on your EAD has been reached).

If you requested an SSN while filing your I-765 application for OPT, you do not need to separately apply for an SSN. You should receive your SSN within 2-4 weeks of receiving your OPT EAD.

J-1 Research Scholar, Professor, or Short-Term Scholar Offer/invitation letter from your academic department. J-1 Student Interns - Form DS-7002.

- Offer/invitation letter from hosting department.

- Social Security Employment Verification Letter endorsed by ISSS.

- Download the Social Security Employment Verification Letter.

- Have your employing department complete the top portion of the letter.

- Obtain a signature on the bottom portion from ISSS. Please bring the Employment Verification Letter to J-1 Orientation or email scholars@austin.utexas.edu for confirmation on when you can obtain the signature from ISSS.

J-1 Students on Academic Training - Academic Training authorization letter.

- Original DS-2019 with Academic Training notation in section 5 and wet ink signature from ISSS staff in section 7.

- Job offer letter.

J-2 Dependents Employment Authorization document (EAD) issued by USCIS. H-1B Copy of your I-797 H-1B approval notice. *We recommend taking a copy of the SSA policy guidance to your appointment. This guidance confirms that print-outs of electronically-issued I-20s are acceptable. You can show it to staff if they are unsure of whether they can accept your I-20.

Step 3: Attend Your Appointment

- Make sure your appointment is not too early, as this can cause significant delays. See Step 1 above for timing considerations.

- Make sure you have all the required documents for your appointment. See Step 2, above.

- Arrive to your appointment early with all required documentation.

- You should receive an automated text message around 30 minutes prior to your appointment. It will be sent to the phone number you entered when scheduling your appointment online. Check in using the link in the text message. You should then receive a ticket number.

- When your number is called, meet with the SSA staff.

- After the SSA staff successfully verify your identity and eligibility for an SSN, you will receive a receipt confirming the address where your SSN will be sent. Please ensure this address is accurate.

Step 4: Obtain Your SSN and Update Relevant UT Austin Offices

You should receive your paper SSN card in the mail 2-4 weeks after your appointment. Once you have obtained your SSN, be sure to report it to the University to update your records.

Step 5: Stay Safe!

The SSN is a number unique to you and you only. If stolen, it can be used to commit identity theft. Stay safe by following these tips:

- Do not share your SSN with anyone unless they have a legitimate business purpose for it. Entities that may have a legitimate need for your SSN include the UT Austin offices of the Registrar, Human Resources, and Payroll Services, as well as any non-UT employer you work for.

- To avoid theft of this sensitive document, do not carry your SSN card with you. Keep it at home in a safe place.

- Problems With Student and Scholar Visa Status Verification

Government agencies use the SAVE system, which stands for Systematic Alien Verification for Entitlements, to determine if you are in a valid immigration status before granting a benefit such as a driver’s license or social security number. Sometimes the officer assisting you at Social Security Administration (SSA) may not be able to immediately verify your valid student or scholar visa status. If the SSA officer is not able to verify your status in the SAVE system, you should politely ask to speak with a supervisor. Supervisors at SSA may have more training in F-1 and J-1 visa issues and be better able to assist in the SAVE verification process. If a supervisor is not able to verify your valid student status, SSA should initiate a secondary verification process.

Here are some common reasons students and scholars are not able to get a Social Security Number on the first try:

- You have gone to the SSA office too early. After you arrive in the U.S., Texas Global updates your SEVIS record (I-20 or DS-2019) to show that you are here and that you have checked in with our office. Students should plan to wait at least 10 days from entering the U.S. and at least 2 days from registering for classes before visiting SSA. J-1 scholars should wait at least 10 days from entering the U.S. and 3 days after attending the J-1 Scholar Orientation. Transfer students and students who have an I-20 that has been updated for change of level will need to wait at least two days after checking in and registering for classes before visiting SSA.

- Inconsistencies in your immigration documents. If your name on your I-20 or DS-2019 does not match your passport exactly, please bring this to the attention of Texas Global before visiting SSA.

- You have a pending change of status or OPT application. If you are changing to a new immigration status or you are applying for OPT, it may be difficult for the SSA officer to verify your valid status. If this is the case for you, be sure to ask to meet with a supervisor at SSA. Even if you meet with a supervisor, additional research may be required to verify your status. If this is the case, the SSA officer will initiate a secondary verification of your status. You should expect delays in the processing of your Social Security Number if you have a pending OPT or STEM OPT application, you have a cap gap I-20, or you have a pending change of status application.

What to do if your status cannot be verified:

- Be sure to bring all immigration documents with you to your appointment with SSA:

- If you have a pending change of status or OPT application, your status may need to be verified by using the USCIS case number instead of your SEVIS ID.

- If you are on OPT and have a pending H1B petition, be sure to bring your cap gap I-20 with you, along with the I-797C receipt notice from USCIS.

- If SSA refers you to UT Texas Global to discuss your status, collect as much information as possible, then make an appointment to meet with an international advisor. Ask the agency for details about the issue and take notes so an advisor in Texas Global can best assist you:

- Is secondary verification in SAVE in progress?

- What is your SAVE verification case number?

- What documents were reviewed in the visit?

- What error message was received?

- Which system or database was used?

- If SAVE verification is not the issue, what other factors are making you ineligible for the benefit?

- You can monitor the progress of your secondary verification on the SAVE verification website. Be sure to ask SSA when you can return for services after your case has been resolved. Although your case may be resolved in SAVE, the information may take additional time to sync with agency databases.

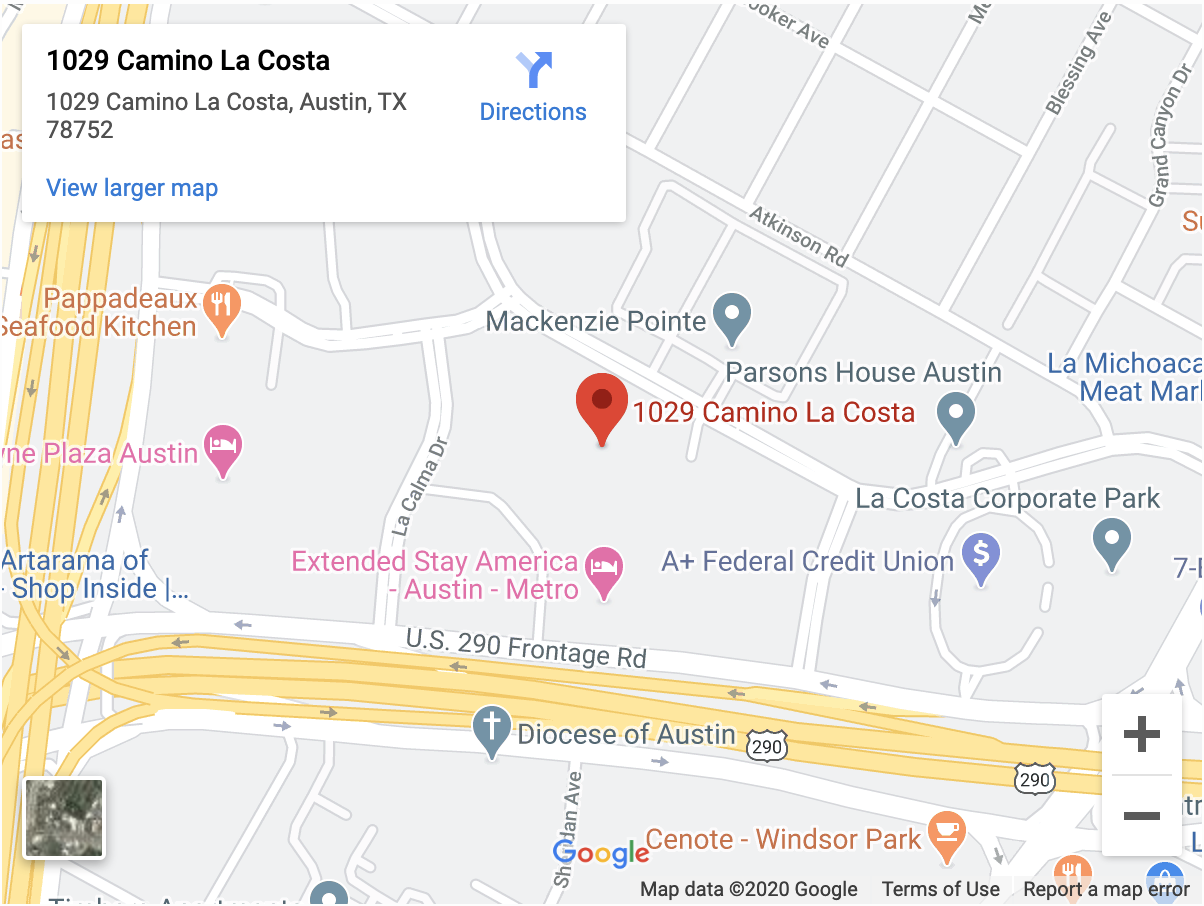

Directions to the Social Security Office

1029 Camino La Costa

Austin, TX 78752

Phones: 1-866-627-6991 or 1-800-772-1213

Hours: 9 am – 4 pm (Mon, Tue, Thu, & Fri), 9 am – 12 pm (Wed)

For bus routes go to https://www.capmetro.org or call 512-474-1200

I Do Not Have an SSN or Am Not Eligible For an SSN

If you do not currently have a Social Security Number (SSN) and are not currently eligible for an SSN (i.e. you do not have employment), you will need to apply for an ITIN to facilitate payment for scholarships and/or to file your U.S. tax return.

- Visit our ITIN page for more information.