McCombs Tax Study Reveals Global Implications for Corporate Innovation

- Jun 15, 2023

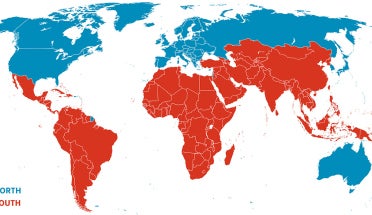

A study from The University of Texas at Austin has found countries that offer tax breaks for corporate innovation realize greater economic growth than those with no such policies.

Researching seven countries from 1999 to 2017, the study’s authors found that tax cuts for income resulting from intellectual property — such as patents, copyrights and trademarks — lead to greater capital investment and increased average pay for employees.

Published in The Accounting Review, the study was co-authored by Lisa De Simone, associate professor of accounting at the McCombs School of Business, and offers valuable insight for U.S. policymakers — who some argue have fallen short of enacting provisions that truly reward innovation.

“We showed the tangible results of tax cuts for intellectual property,” said De Simone, who researches how tax policy influences where companies decide to put their offices, factories and people. “This is important information for policymakers as they consider changes to tax regulations.”

Countries cutting taxes for intellectual property activity saw 2.6 percent higher levels of capital expenditures, including assets such as factories and machinery, compared with similar countries offering no tax incentive. But a significant rate cut — 60 percent or more — was needed to show results.

Although the study found no bump in hiring or overall compensation from these policies, it did find increased average pay for employees, probably including higher-skilled research and development workers. Workers earned at least 46,844 euros more, equal to $49,525.

Read more on the McCombs School's faculty research and expertise website, Big Ideas.